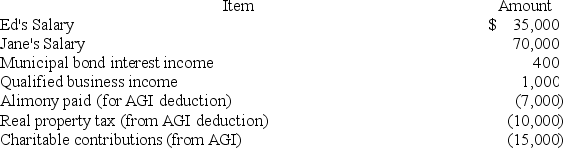

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What is the couple's adjusted gross income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q101: Jasmine and her husband Arty have been

Q101: John Maylor is a self-employed plumber of

Q104: In April of year 1,Martin left his

Q105: Sam and Tracy have been married for 25

Q110: The Dashwoods have calculated their taxable income

Q112: Kabuo and Melinda got married on December

Q115: In year 1,Harold Weston's wife died.Since her

Q117: Sullivan's wife Susan died four years ago.Sullivan

Q119: Jane and Ed Rochester are married with

Q120: Miguel,a widower whose wife died in year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents