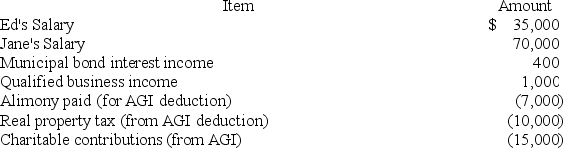

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What are the couple's taxes due or tax refund (use the tax rate schedules not tax tables)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: In June of year 1,Jake's wife Darla

Q89: In June of year 1,Eric's wife Savannah

Q94: Which of the following statements about a

Q102: The Tanakas filed jointly in 2018.Their AGI

Q104: For filing status purposes, the taxpayer's marital

Q106: Jane and Ed Rochester are married with

Q108: The Inouyes filed jointly in 2018.Their AGI

Q109: For purposes ofdetermining filing status, which of

Q113: Mason and his wife Madison have been

Q114: Tom Suzuki's tax liability for the year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents