Peters Ltd has a machine that originally cost $20,000 and has accumulated depreciation of $5,000. Its remaining life is assessed to be 5 years with no salvage value. The directors of Peters Ltd decide on 1 July 2003 to revalue the machine. They are unable to find market information on a machine in a similar state to theirs, so the market value of a new machine of the same type, $30,000, is used as a basis. What is/are the appropriate journal entry(ies) to record the revaluation?

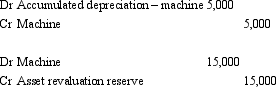

A)

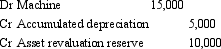

B)

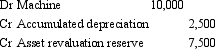

C)

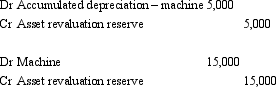

D)

E) None of the given answers.

Correct Answer:

Verified

Q1: Once an entity elects to value a

Q9: Positive accounting theory suggests that the revalution

Q19: AASB 136 does not require the use

Q22: Seagull Marinas Ltd owns land that was

Q24: AASB 116 provides guidance on fair values

Q26: Cars and Trucks Limited owns an engine

Q27: Staples Ltd has invested in two parcels

Q28: Pigeon Ltd purchased land for $750,000 6

Q33: Where the value of revalued non-current assets

Q35: Where an asset's carrying amount based on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents