Cars and Trucks Limited owns an engine testing machine which was purchased for $120,000. After 3 years of use the machine had accumulated depreciation of $58,560 but was revalued to $80,000. Two years later the machine was sold for $60,000 and had accumulated depreciation at the time of sale of $36,800. What journal entries would be required to record the sale of the machine in accordance with AASB 116 requirements?

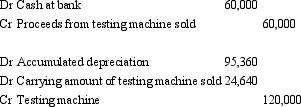

A)

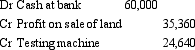

B)

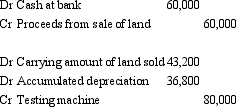

C)

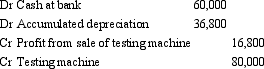

D)

E) None of the given answers.

Correct Answer:

Verified

Q22: Seagull Marinas Ltd owns land that was

Q23: Peters Ltd has a machine that originally

Q24: AASB 116 provides guidance on fair values

Q27: Staples Ltd has invested in two parcels

Q27: Casey Co Ltd is assessing the recoverable

Q28: Pigeon Ltd purchased land for $750,000 6

Q29: Stairway Ltd is undertaking its regular review

Q30: Manchester Ltd has a building that originally

Q33: Where the value of revalued non-current assets

Q35: Where an asset's carrying amount based on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents