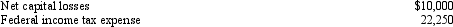

For 2011,the Butternut Corporation has net income on its books of $75,000,including the following items:  Federal tax depreciation exceeds the depreciation deducted on the books by $7,250.What is the corporation's taxable income?

Federal tax depreciation exceeds the depreciation deducted on the books by $7,250.What is the corporation's taxable income?

A) $75,000

B) $85,000

C) $97,250

D) $100,000

E) $107,250

Correct Answer:

Verified

Q2: For 2011,M & K Corporation had taxable

Q3: The Sapote Corporation is a manufacturing corporation.The

Q4: Firethorn Corporation began business on May 1,2011,and

Q5: In 2011,which of the following is a

Q6: The Brush Cherry Corporation has a $75,000

Q7: If the following businesses are owned by

Q8: Which of the following is true concerning

Q9: In 2011,Parsley Corp had $385,000 of revenue

Q10: Phil forms the Elm Corporation during 2011.He

Q11: For the year ended December 31,2011,Prunus,Inc. ,reported

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents