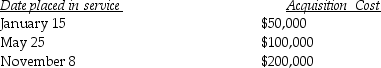

Mehmet, a calendar-year taxpayer, acquires 5-year tangible personal property in 2014 and does not use Sec. 179. Mehmet places the property in service on the following schedule:

What is the total depreciation for 2012?

What is the total depreciation for 2012?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: On May 1,2008,Empire Properties Corp.,a calendar year

Q82: On June 30,2014,Temika purchased office furniture (7-year

Q88: During the year 2014, a calendar year

Q88: In January of 2014,Brett purchased a Porsche

Q92: Stellar Corporation purchased all of the assets

Q93: On May 1,2012,Empire Properties Corp.,a calendar year

Q93: Bert,a self-employed attorney,is considering either purchasing or

Q2094: Jack purchases land which he plans on

Q2119: Why would a taxpayer elect to capitalize

Q2138: Why would a taxpayer elect to use

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents