Strumpf Ltd. decides to issue a convertible bond with a maturity of two years. Each bond is issued with a nominal value of £100 and an annual coupon C; of course, C has to be determined. Each bond can be redeemed for £100 or converted into one share of Strumpf at the option of the bondholder.

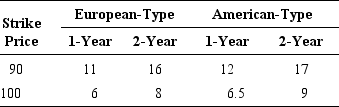

The current stock price of Strumpf is £90. The yield curve for an issuer like Strumpf is flat at 6%. Barings is ready to issue long-term options on Strumpf shares. The premiums on calls with one-year and two-year expirations are given below:

a. American-type calls are more expensive than European-type calls. Is it reasonable?

a. American-type calls are more expensive than European-type calls. Is it reasonable?

b. Assume that the bond can only be converted at maturity, after payment of the second coupon. What should be the fair coupon rate C, consistent with the above market conditions?

c. Assume that the bond is issued with the coupon rate determined above. The yield curve suddenly moves from 6% to 6.1% and the option premiums stay the same. What should be the new market price of the convertible bond?

d. Assume now that the bond can be converted on two dates (rather than one as above). These dates are the first year (right after the first coupon payment) and the second year as above. It is not possible to convert the two-year bond at any other date. Is it possible to construct an arbitrage portfolio allowing to price the fair coupon C with the above data? Be precise in your explanation and state what type of options you would need to price the bond.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q39: A company without default risk can issue

Q40: A company without default risk can

Q41: You're a banker. A client wishes to

Q42: The Kingdom of Papou issues a very-bull

Q43: A nine-year bond has a yield-to-maturity of

Q45: On April 1, 2000, a corporation

Q46: Guaranteed note.

You are a young banker offering

Q47: Inflation indexed bonds.

Many countries, among which

Q48: Which of the following statements about the

Q49: The French luxury-goods company LVMH, Louis Vuitton-Moët

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents