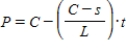

A business purchasing an item for business purposes may use straight-line depreciation to obtain a tax deduction. The formula for the present value, P, after t years is given below, where C is the cost and s is the scrap value after L years. The number L is called the useful life of the item.

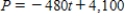

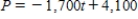

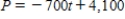

If a certain piece of equipment costs $4,100 and has a scrap value of $1,700 after 5 years, write an equation to represent the present value after t years.

A)

B)

C)

D)

E)

Correct Answer:

Verified

Q63: Graph the line. Q64: Graph the line passing through (1, 3) Q65: If a present value P is invested Q66: Graph the line passing through (-2, 2) Q67: Find three ordered pairs that satisfy the Q69: A business purchasing an item for business Q70: A business purchasing an item for business Q71: Graph the line. Q72: Find three ordered pairs that satisfy the Q73: Graph the line. Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()