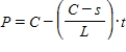

A business purchasing an item for business purposes may use straight-line depreciation to obtain a tax deduction. The formula for the present value, P, after t years is given below, where C is the cost and s is the scrap value after L years. The number L is called the useful life of the item.

If a certain piece of equipment costs $8,100 and has a scrap value of $2,100 after 10 years, write an equation to represent the present value after t years.

Correct Answer:

Verified

Q64: Graph the line passing through (1, 3)

Q65: If a present value P is invested

Q66: Graph the line passing through (-2, 2)

Q67: Find three ordered pairs that satisfy the

Q68: A business purchasing an item for business

Q69: A business purchasing an item for business

Q71: Graph the line. Q72: Find three ordered pairs that satisfy the Q73: Graph the line. Q74: A business purchasing an item for business![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents