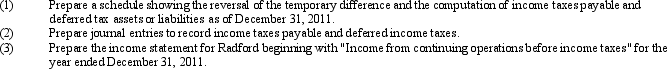

Radford Appliances computed a pretax financial loss of $60,000 for the first year of its operations ended December 31, 2011. Analysis of the tax and book basis of its liabilities disclosed $80,000 in accrued warranty expenses on the books that had not been deductible from taxable income in 2011, but would be deductible in future years when the warranty expenses were paid.

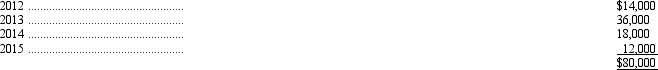

The future warranty payments are expected to occur in the following pattern:

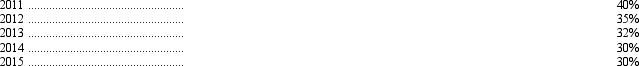

The enacted tax rates for this year and the next four years are as follows:

Use the provisions of FASB Statement No. 109.

Correct Answer:

Verified

Q61: The application of SFAS No.109 results in

Q62: Pretax accounting income is $100,000 and the

Q69: The Internal Revenue Code allows a corporation

Q71: Walsh Services computed pretax financial income of

Q72: Many non-accountants are confused when they hear

Q74: Halverson Company reported taxable income of $60,000

Q74: A major conceptual issue regarding the accounting

Q77: Garrison Designs, Inc., a corporation organized on

Q81: SFAS No.109 uses the term "tax-planning strategy".The

Q84: SFAS No 109 takes a decidedly different

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents