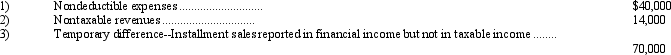

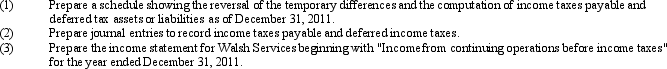

Walsh Services computed pretax financial income of $220,000 for its first year of operations ended December 31, 2011. In preparing the income tax return for the year, the tax accountant determined the following differences between 2011 financial income and taxable income:

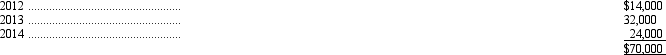

The temporary difference is expected to reverse in the following pattern:

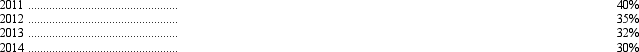

The enacted tax rates for this year and the next three years are as follows:

Use the provisions of FASB Statement No. 109.

Correct Answer:

Verified

Q61: The application of SFAS No.109 results in

Q62: Pretax accounting income is $100,000 and the

Q69: The Internal Revenue Code allows a corporation

Q72: Many non-accountants are confused when they hear

Q74: A major conceptual issue regarding the accounting

Q74: Halverson Company reported taxable income of $60,000

Q76: Radford Appliances computed a pretax financial loss

Q81: SFAS No.109 uses the term "tax-planning strategy".The

Q84: SFAS No 109 takes a decidedly different

Q85: SFAS No.109 rejected the approach of its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents