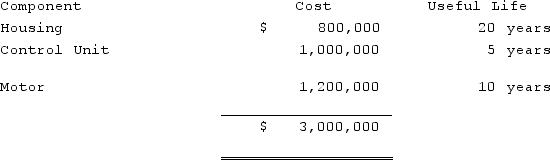

Teapot, Ltd. is a foreign company that uses IFRS for its financial reporting. Teapot is a wholly-owned subsidiary of Davis Housewares Corp. which is a U.S. company that prepares its consolidated financial statements in accordance with U.S. GAAP. Teapot purchased a piece of equipment for $3,000,000 on January 1, 2020. The equipment has an overall useful life of 20 years and no salvage value. The equipment is comprised of the following three significant components, shown with their associated cost and useful life.  As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.On December 31, 2020, Wave Corp. a foreign subsidiary of Pepper Corp., had a bank overdraft of $30,000 on one of its bank accounts. Bank overdrafts are an integral part of Wave's cash management policy.1) Prepare the journal entry to convert the foreign subsidiary from its IFRS financial statements to U.S.GAAP financial statements.2) Briefly explain why this journal entry is required.

As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.On December 31, 2020, Wave Corp. a foreign subsidiary of Pepper Corp., had a bank overdraft of $30,000 on one of its bank accounts. Bank overdrafts are an integral part of Wave's cash management policy.1) Prepare the journal entry to convert the foreign subsidiary from its IFRS financial statements to U.S.GAAP financial statements.2) Briefly explain why this journal entry is required.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q55: What are the four different ways IFRS

Q56: What is the IOSCO?

Q57: The major providers of financing in some

Q58: IFRS 1 requires companies transitioning to IFRS

Q59: All of the following are successful FASB-IASB

Q60: What two reconciliations are required by IFRS

Q61: Teapot, Ltd. is a foreign company that

Q62: Teapot, Ltd. is a foreign company that

Q63: Teapot, Ltd. is a foreign company that

Q64: What are measurement differences in financial reporting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents