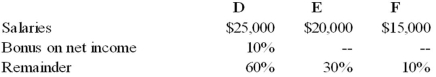

The DEF partnership reported net income of $130,000 for the year ended December 31, 20X8. According to the partnership agreement, partnership profits and losses are to be distributed as follows:  How should partnership net income for 20X8 be allocated to D, E, and F?

How should partnership net income for 20X8 be allocated to D, E, and F?

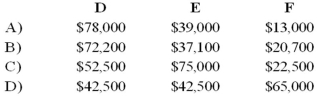

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q1: Shue,a partner in the Financial Brokers Partnership,has

Q2: The APB partnership agreement specifies that partnership

Q4: The APB partnership agreement specifies that partnership

Q4: When a partnership is formed,noncash assets contributed

Q5: Griffin and Rhodes formed a partnership on

Q5: RD formed a partnership on February 10,

Q6: Note: This is a Kaplan CPA Review

Q9: Which of the following accounts could be

Q10: Note: This is a Kaplan CPA Review

Q16: The partnership of X and Y shares

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents