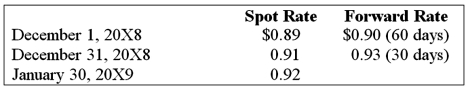

Taste Bits Inc. purchased chocolates from Switzerland for 200,000 Swiss francs (SFr) on December 1, 20X8. Payment is due on January 30, 20X9. On December 1, 20X8, the company also entered into a 60-day forward contract to purchase 100,000 Swiss francs. The forward contract is not designated as a hedge. The rates were as follows:  Based on the preceding information, the entries on January 30, 20X9, include a:

Based on the preceding information, the entries on January 30, 20X9, include a:

A) Credit to Foreign Currency Units (SFr) , $184,000.

B) Credit to Cash, $180,000.

C) Debit to Foreign Currency Transaction Loss, $4,000.

D) Debit to Dollars Payable to Exchange Broker, $184,000.

Correct Answer:

Verified

Q35: On December 1, 20X8, Hedge Company entered

Q36: Myway Company sold equipment to a Canadian

Q37: Taste Bits Inc. purchased chocolates from Switzerland

Q38: On December 1, 20X8, Hedge Company entered

Q39: Myway Company sold equipment to a Canadian

Q41: Spiralling crude oil prices prompted AMAR Company

Q43: Note: This is a Kaplan CPA Review

Q44: On December 1, 20X8, Winston Corporation acquired

Q45: Quantum Company imports goods from different countries.

Q67: Which of the following observations is true

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents