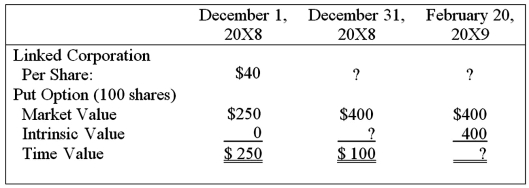

On December 1, 20X8, Winston Corporation acquired 100 shares of Linked Corporation at a cost of $40 per share. Winston classifies them as available-for-sale securities. On this same date, it decides to hedge against a possible decline in the value of the securities by purchasing, at a cost of $250, an at-the-money put option to sell the 100 shares at $40 per share. The option expires on February 20, 20X9. Selected information concerning the fair values of the investment and the options follow:  Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

Based on the preceding information, what is the market price of Linked Corporation stock on February 20, 20X9?

A) $35

B) $37

C) $36

D) $40

Correct Answer:

Verified

Q39: Myway Company sold equipment to a Canadian

Q40: Taste Bits Inc. purchased chocolates from Switzerland

Q41: Spiralling crude oil prices prompted AMAR Company

Q43: Note: This is a Kaplan CPA Review

Q45: Quantum Company imports goods from different countries.

Q46: Spiralling crude oil prices prompted AMAR Company

Q47: The fair market value of a near-month

Q48: All of the following are management tools

Q49: On December 1, 20X8, Secure Company bought

Q67: Which of the following observations is true

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents