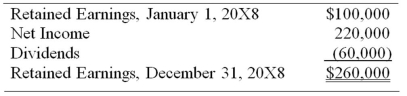

For the first quarter of 20X8, Vinyl Corporation reported sales of $150,000 and operating expenses of $100,000, and paid dividends of $20,000. Vinyl Company operates on a calendar-year basis. On April 1, 20X8, Signature Corporation acquired 80 percent of Vinyl's common stock for $320,000. At that date, the fair value of the noncontrolling interest was $80,000, and Vinyl had 20,000 shares of $5 par common stock outstanding, originally issued at $12 per share. The differential is related to goodwill. On December 31, 20X8, the management of Signature Corporation reviewed the amount attributed to goodwill as a result of its acquisition of Vinyl common stock and concluded that goodwill was not impaired. Vinyl's retained earnings statement for the full year 20X8 appears as follows:

Signature uses the fully adjusted equity method in accounting for this investment:

Required:

1) Prepare all entries that Signature would have recorded in accounting for its investment in Vinyl during 20X8.

2) Present all eliminating entries needed in a worksheet to prepare a complete set of consolidated financial statements for the year 20X8.

Correct Answer:

Verified

Q34: Company A owns 85 percent of Company

Q35: Locus Corporation acquired 80 percent ownership of

Q36: Electric Corporation holds 80 percent of Utility

Q37: Company A owns 85 percent of Company

Q38: Company A owns 85 percent of Company

Q39: Denver Corporation owns 25 percent of the

Q40: On January 1, 20X8, Gulfstream Corporation acquired

Q41: Power Corporation owns 75 percent of Transmitter

Q42: Boycott Company holds 75 percent ownership of

Q44: On December 31, 20X7, Planet Corporation acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents