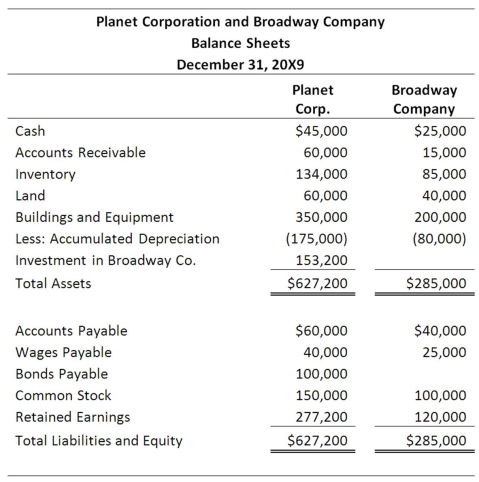

On December 31, 20X7, Planet Corporation acquired 80 percent of Broadway Company's stock, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 20 percent of the book value of Broadway Company. The two companies' balance sheets on December 31, 20X9, are as follows:

On December 31, 20X9, Planet holds inventory purchased from Broadway for $40,000. Broadway's cost of producing the merchandise was $25,000. Broadway's ending inventory also contains $30,000 of purchases from Planet that had cost it $20,000 to produce.

On December 30, 20X9, Broadway sold equipment to Planet for $40,000. Broadway had purchased the equipment for $60,000 several years earlier. At the time of sale to Planet, the equipment had a book value of $20,000. The two companies file separate tax returns and are subject to a 40 percent tax rate. Planet does not record tax expense on its share of Broadway's undistributed earnings.

Required:

1) Prepare the eliminating entries necessary to complete a consolidated balance sheet worksheet as of December 31, 20X9.

2) Complete a consolidated balance sheet worksheet as of December 31, 20X9.

Correct Answer:

Verified

Q34: Company A owns 85 percent of Company

Q35: Locus Corporation acquired 80 percent ownership of

Q36: Electric Corporation holds 80 percent of Utility

Q37: Company A owns 85 percent of Company

Q38: Company A owns 85 percent of Company

Q39: Denver Corporation owns 25 percent of the

Q40: On January 1, 20X8, Gulfstream Corporation acquired

Q41: Power Corporation owns 75 percent of Transmitter

Q42: Boycott Company holds 75 percent ownership of

Q43: For the first quarter of 20X8, Vinyl

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents