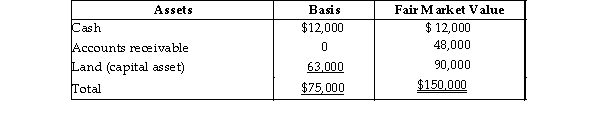

The CHS Partnership's balance sheet presented below is prepared on a cash basis at September 30 of the current year.

Cindy withdraws from the partnership under an agreement whereby she takes one- third of each of the three assets and assumes $10,000 of the notes payable. Her basis for the partnership interest before any distribution is

$25,000. What gain/loss should she report for tax purposes?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: Identify which of the following statements is

Q48: Ted King's basis for his interest in

Q49: A partner's holding period for a partnership

Q56: On December 31, Kate receives a $28,000

Q57: A partner can recognize gain, but not

Q58: Eicho's interest in the DPQ Partnership is

Q58: The HMS Partnership, a cash method of

Q60: Adnan had an adjusted basis of $11,000

Q62: Tony sells his one- fourth interest in

Q68: What is the character of the gain/loss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents