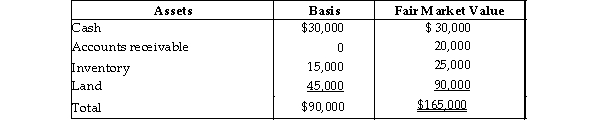

On December 31, Kate receives a $28,000 liquidating distribution from the KLM Partnership. On that date, Kate's basis in her limited partnership interest is $18,000 (which, of course, includes her share of partnership liabilities). The other partners assume her $6,000 share of liabilities. Just prior to the distribution, the partnership has the following balance sheet. Kate is leaving the partnership but the partnership is continuing.

What is the amount and character of the gain that Kate must recognize on the liquidating distribution?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: Identify which of the following statements is

Q48: Ted King's basis for his interest in

Q49: A partner's holding period for a partnership

Q50: Do most distributions made by a partnership

Q57: A partner can recognize gain, but not

Q57: The CHS Partnership's balance sheet presented below

Q58: Eicho's interest in the DPQ Partnership is

Q58: The HMS Partnership, a cash method of

Q60: Adnan had an adjusted basis of $11,000

Q68: What is the character of the gain/loss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents