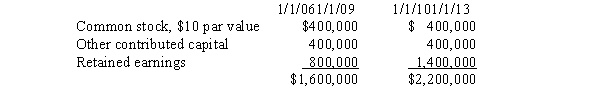

On January 1, 2009, Parent Company purchased 32,000 of the 40,000 outstanding common shares of Sub Company for $1,520,000.On January 1, 2013, Parent Company sold 4,000 of its shares of Sub Company on the open market for $90 per share.Sub Company's stockholders' equity on January 1, 2009, and January 1, 2013, was as follows:  The difference between implied and book value is assigned to Sub Company's land.The amount of the gain on sale of the 4,000 shares that should be recorded on the books of Parent Company is

The difference between implied and book value is assigned to Sub Company's land.The amount of the gain on sale of the 4,000 shares that should be recorded on the books of Parent Company is

A) $68,000.

B) $170,000.

C) $96,000.

D) $200,000.

E) None of these.

Correct Answer:

Verified

Q7: When the parent company sells a portion

Q14: On January 1 2013, Paulus Company purchased

Q15: On January 1, 2013, P Corporation purchased

Q17: On January 1, 2009, Pine Corporation purchased

Q18: On January 1 2013, Pounder Company purchased

Q20: The computation of noncontrolling interest in net

Q21: Pamela Company acquired 80% of the outstanding

Q22: Poole made the following purchases of Smarte

Q23: On January 1, 2011, Panel Company acquired

Q24: Partner Company acquired 85% of the common

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents