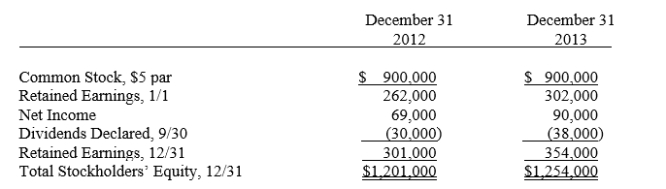

Partner Company acquired 85% of the common stock of Simplex Company in two separate cash transactions.The first purchase of 108,000 shares (60%) on January 1, 2012, cost $735,000.The second purchase, one year later, of 45,000 shares (25%) cost $330,000.Simplex Company's stockholders' equity was as follows:

On April 1, 2013, after a significant rise in the market price of Simplex Company's stock, Partner Company sold 32,400 of its Simplex Company shares for $390,000.Simplex Company notified Partner Company that its net income for the first three months was $22,000.The shares sold were identified as those obtained in the first purchase.Any difference between cost and book value relates to goodwill.Partner uses the partial equity method to account for its investment in Simplex Company.

Required:

A.Prepare the journal entries Partner Company will make on its books during 2012 and 2013 to account for its investment in Simplex Company.

B.Prepare the workpaper eliminating entries needed for a consolidated statements workpaper on December 31, 2013.

Correct Answer:

Verified

Q7: When the parent company sells a portion

Q17: On January 1, 2009, Pine Corporation purchased

Q18: On January 1 2013, Pounder Company purchased

Q19: On January 1, 2009, Parent Company purchased

Q21: Pamela Company acquired 80% of the outstanding

Q22: Poole made the following purchases of Smarte

Q23: On January 1, 2011, Panel Company acquired

Q25: Pizza Company purchased Salt Company common stock

Q26: Pratt Company purchased 40,000 shares of Silas

Q27: P Company purchased 96,000 shares of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents