Pine Company owns an 80% interest in Salad Company and a 90% interest in Tuna Company.During 2013 and 2014, intercompany sales of merchandise were made by all three companies.Total sales amounted to $2,400,000 in 2013, and $2,700,000 in 2014.The companies sold their merchandise at the following percentages above cost.

Pine 15%

Salad 20%

Tuna 25%

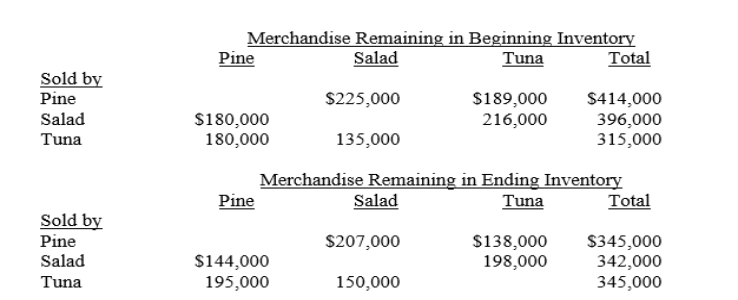

The amount of merchandise remaining in the 2014 beginning and ending inventories of the companies from these intercompany sales is shown below.

Reported net incomes (from independent operations including sales to affiliates) of Pine, Salad, and Tuna for 2014 were $3,600,000, $1,500,000, and $2,400,000, respectively.

Required:

A.Calculate the amount noncontrolling interest to be deducted from consolidated income in the consolidated income statement for 2014.

B.Calculate the controlling interest in consolidated net income for 2014.

Correct Answer:

Verified

Q30: P Company sells inventory costing $100,000 to

Q31: Past and proposed GAAP agree that unrealized

Q31: Poole Company owns a 90% interest in

Q32: Determination of the noncontrolling interest in consolidated

Q33: Use the following information for Questions 22

Q34: Why are adjustments made to the calculation

Q36: Use the following information for Questions 24

Q37: What procedure is used in the consolidated

Q38: Pinta Company owns 90% of the common

Q39: Why is the gross profit on intercompany

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents