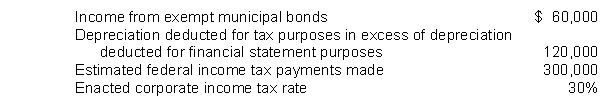

Haag Corp.'s 2015 income statement showed pretax accounting income of $1,500,000. To compute the federal income tax liability, the following 2015 data are provided:  What amount of current federal income tax liability should be included in Hagg's December 31, 2015 balance sheet?

What amount of current federal income tax liability should be included in Hagg's December 31, 2015 balance sheet?

A) $ 96,000

B) $132,000

C) $150,000

D) $396,000

Correct Answer:

Verified

Q86: Based on the following information, compute 2015

Q87: Foltz Corp.'s 2014 income statement had pretax

Q88: Rodd Co. reports a taxable and pretax

Q89: Palmer Co. had a deferred tax liability

Q90: Didde Corp. prepared the following reconciliation of

Q92: At December 31, 2014 Raymond Corporation reported

Q93: Larsen Corporation reported $100,000 in revenues in

Q94: Use the following information for questions 89

Q95: Duncan Inc. uses the accrual method of

Q96: A reconciliation of Gentry Company's pretax accounting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents