Foltz Corp.'s 2014 income statement had pretax financial income of $250,000 in its first year of operations. Foltz uses an accelerated cost recovery method on its tax return and straight-line depreciation for financial reporting. The differences between the book and tax deductions for depreciation over the five-year life of the assets acquired in 2014, and the enacted tax rates for 2014 to 2018 are as follows:  There are no other temporary differences. In Foltz's December 31, 2014 balance sheet, the noncurrent deferred income tax liability and the income taxes currently payable should be

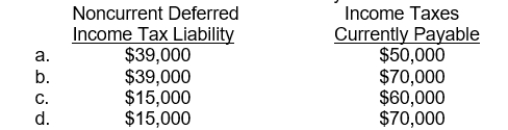

There are no other temporary differences. In Foltz's December 31, 2014 balance sheet, the noncurrent deferred income tax liability and the income taxes currently payable should be

Correct Answer:

Verified

Q82: Use the following information for questions 89

Q83: Fleming Company has the following cumulative taxable

Q84: Use the following information for questions 93

Q85: Nickerson Corporation began operations in 2013. There

Q86: Based on the following information, compute 2015

Q88: Rodd Co. reports a taxable and pretax

Q89: Palmer Co. had a deferred tax liability

Q90: Didde Corp. prepared the following reconciliation of

Q91: Haag Corp.'s 2015 income statement showed pretax

Q92: At December 31, 2014 Raymond Corporation reported

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents