Parrot, Inc. purchased a 60% interest in Swallow Company on January 1, 20X1, for $204,000. Any excess of cost was attributable to goodwill.

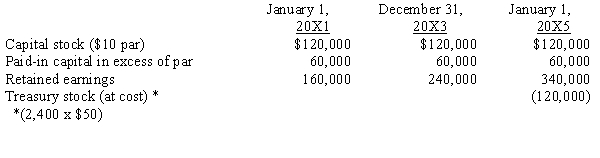

On January 1, 20X4, Swallow purchased 2,400 of its shares held by noncontrolling stockholders for $50 per share. Swallow equity balances on various dates were as follows:

Parrot maintains its investment at cost; Swallow recorded the purchase of its shares as treasury stock at cost.

Required:

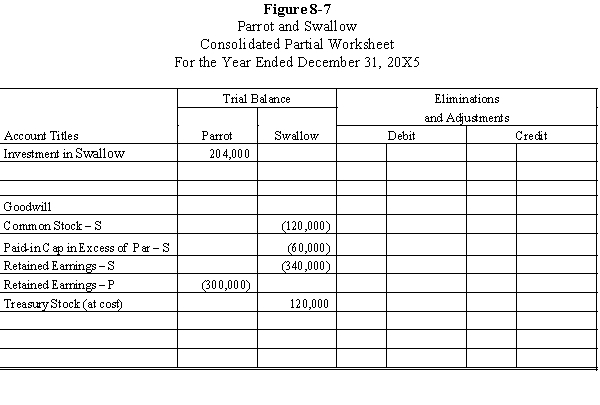

Prepare the necessary determination and distribution of excess schedules and all Figure 8-7 worksheet eliminations and adjustments on the following partial worksheet prepared on December 31, 20X5:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Pepper Company owns 60,000 of Salt Company's

Q18: Pepper Company owned 60,000 of Salt Company's

Q19: Apple Inc. owns a 90% interest in

Q20: Able Company owns an 80% interest in

Q21: Company P had 300,000 shares of common

Q23: A owns 80% of B and 20%

Q24: Manke Company owns a 90% interest in

Q24: On January 1, 20X1, Prism Company purchased

Q25: On January 1, 20X1, Parent Company purchased

Q27: On January 1, 20X1, Parent Company purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents