On January 1, 20X1, Parent Company purchased 85% of the common stock, 8,500 shares, of Subsidiary Company for $317,500. On this date, Subsidiary had common stock, other paid-in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively. Any excess of cost over book value is due to goodwill.

On January 1, 20X2, Subsidiary purchased, from its noncontrolling shareholders, 1,000 shares of its common stock, 10% of the stock outstanding on that date. The price paid was $44,000.

Required (round all amounts to whole dollars; round percentages to one decimal: XX.X%)

a.Prepare an analysis to determine Parent's revised ownership interest following Sub's treasury stock transaction.

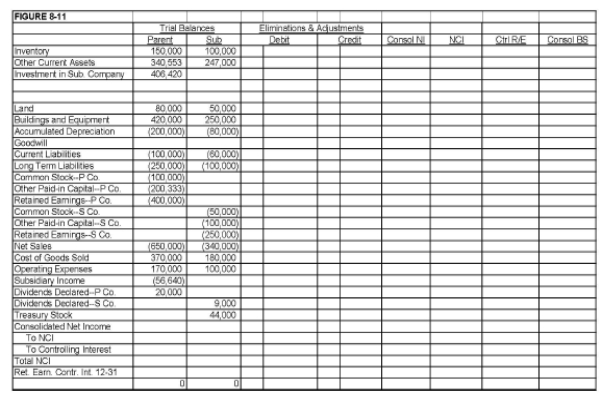

b.Complete the Figure 8-11 worksheet for consolidated financial statements for 20X2

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Company P had 300,000 shares of common

Q22: Parrot, Inc. purchased a 60% interest in

Q23: A owns 80% of B and 20%

Q24: On January 1, 20X1, Prism Company purchased

Q25: On January 1, 20X1, Parent Company purchased

Q28: On January 1, 20X1, Parent Company purchased

Q28: When a subsidiary owns shares of the

Q29: On January 1, 20X1, Parent Company purchased

Q30: On January 1, 20X1, Parent Company purchased

Q32: On 1/1/X1 Poncho acquired an 80% interest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents