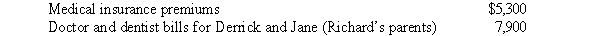

Richard, age 50, is employed as an actuary.For calendar year 2018, he had AGI of $130,000 and paid the following medical expenses:

Derrick and Jane would qualify as Richard's dependents except that they file a joint return.Richard's medical insurance policy does not cover them.Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2018 and received the reimbursement in January 2019.What is Richard's maximum allowable medical expense deduction for 2018?

Derrick and Jane would qualify as Richard's dependents except that they file a joint return.Richard's medical insurance policy does not cover them.Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2018 and received the reimbursement in January 2019.What is Richard's maximum allowable medical expense deduction for 2018?

A) $0

B) $7,090

C) $10,340

D) $20,090

E) None of the above

Correct Answer:

Verified

Q47: Fred and Lucy are married, ages 33

Q58: Ahmad is considering making a $10,000 investment

Q70: Your friend Scotty informs you that he

Q76: Brad, who uses the cash method of

Q90: The exclusion of interest on educational savings

Q104: Nancy paid the following taxes during the

Q107: Karen, a calendar year taxpayer, made the

Q110: During the current year, Ralph made the

Q111: Hugh, a self-employed individual, paid the following

Q112: In 2017, Juan and Juanita incur $9,800

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents