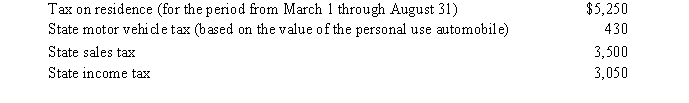

Nancy paid the following taxes during the year:  Nancy sold her personal residence on June 30 of this year under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for Nancy?

Nancy sold her personal residence on June 30 of this year under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for Nancy?

A) $9,180

B) $9,130

C) $7,382

D) $5,382

E) None of the above

Correct Answer:

Verified

Q47: Fred and Lucy are married, ages 33

Q58: The taxpayer is a Ph.D.student in accounting

Q58: Ahmad is considering making a $10,000 investment

Q60: Edna had an accident while competing in

Q76: Brad, who uses the cash method of

Q81: The amount of Social Security benefits received

Q90: The exclusion of interest on educational savings

Q101: Zeke made the following donations to qualified

Q107: Karen, a calendar year taxpayer, made the

Q108: Richard, age 50, is employed as an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents