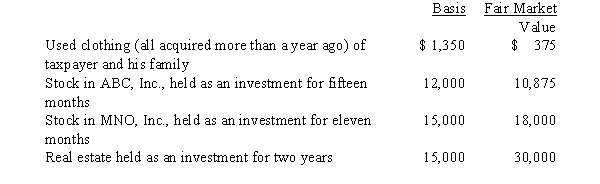

Zeke made the following donations to qualified charitable organizations during the year:  The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations, Zeke's charitable contribution deduction for the year is:

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations, Zeke's charitable contribution deduction for the year is:

A) $43,350.

B) $56,250.

C) $59,250.

D) $60,375.

E) None of the above.

Correct Answer:

Verified

Q47: Fred and Lucy are married, ages 33

Q58: The taxpayer is a Ph.D.student in accounting

Q60: Edna had an accident while competing in

Q61: Tommy, a senior at State College, receives

Q76: Brad, who uses the cash method of

Q81: The amount of Social Security benefits received

Q90: The exclusion of interest on educational savings

Q91: Assuming a taxpayer qualifies for the exclusion

Q97: Early in the year, Marion was in

Q104: Nancy paid the following taxes during the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents