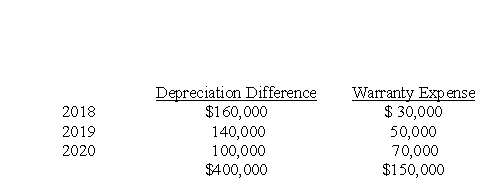

For calendar 2017, Melvin Corp. reported depreciation expense of $800,000 on its income statement, but on its 2017 income tax return, Melvin claimed CCA of $1,200,000. The 2017 income statement also included $150,000 in accrued warranty expense that will be deducted for tax purposes when paid. Melvin's income tax rates are 30% for 2017 and 2015, and 24% for 2018 and 2019. The depreciation difference and warranty expense will reverse over the next three years as follows:  These were Melvin's only reversible differences. At December 31, 2017, Melvin's deferred tax liability should be

These were Melvin's only reversible differences. At December 31, 2017, Melvin's deferred tax liability should be

A) $67,800.

B) $73,200.

C) $75,000.

D) $133,800.

Correct Answer:

Verified

Q21: At the end of 2017, its first

Q22: The use of a Deferred Tax Asset

Q22: Taxable income of a corporation

A) differs from

Q23: Macintyre Inc. sells household furniture on an

Q25: Casey Inc. uses the accrual method of

Q27: For calendar 2017, Peanuts Corp. prepared the

Q28: Tax rates other than the current tax

Q30: Columbia Corp.'s partial income statement for its

Q31: On January 1, 2017, Wings Inc. purchased

Q45: Recognition of tax benefits in a loss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents