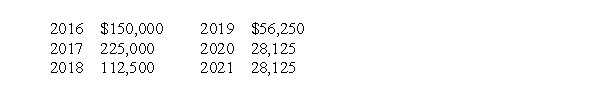

On January 2, 2016, Brunswick Corp. purchased a depreciable asset for $600,000. The asset has an estimated 4 year life with no residual value. Straight-line depreciation is being used for financial statement purposes but the following CCA amounts will be deducted for tax purposes:  Assuming an income tax rate of 30% for all years, the deferred tax liability that should be reflected on Brunswick's statement of financial position at December 31, 2017, should be

Assuming an income tax rate of 30% for all years, the deferred tax liability that should be reflected on Brunswick's statement of financial position at December 31, 2017, should be

A) $22,500.

B) $33,750.

C) $45,000.

D) $50,625.

Correct Answer:

Verified

Q42: At the end of 2017, its first

Q43: At the end of 2017, its first

Q44: Saucy Inc. reported a taxable and accounting

Q45: In 2017, Savoury Ltd. accrued, for book

Q46: Night Owl Inc. reports a taxable and

Q48: In its 2017 income statement, its first

Q49: At the end of 2017, its first

Q50: Hopper Corporation reported the following results for

Q51: CB Properties Corporation reported the following results

Q52: On January 1, 2017, Lake Corp., a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents