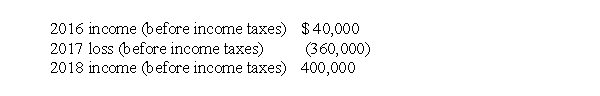

CB Properties Corporation reported the following results for its first three years of operations:  There were no permanent or reversible differences during these three years. Assume an income tax rate of 30% for 2016 and 2017, and 40% for 2018, and that any deferred tax asset recognized is more likely than not to be realized. If CB Properties elects to use the carryforward provisions and not the carryback provisions, what income (loss) is reported for 2017?

There were no permanent or reversible differences during these three years. Assume an income tax rate of 30% for 2016 and 2017, and 40% for 2018, and that any deferred tax asset recognized is more likely than not to be realized. If CB Properties elects to use the carryforward provisions and not the carryback provisions, what income (loss) is reported for 2017?

A) $ 0

B) $(216,000)

C) $(232,000)

D) $(360,000)

Correct Answer:

Verified

Q45: In 2017, Savoury Ltd. accrued, for book

Q46: Night Owl Inc. reports a taxable and

Q47: On January 2, 2016, Brunswick Corp. purchased

Q48: In its 2017 income statement, its first

Q49: At the end of 2017, its first

Q50: Hopper Corporation reported the following results for

Q52: On January 1, 2017, Lake Corp., a

Q53: Gretna Corp. reported the following results for

Q54: At the end of 2017, its first

Q55: At the end of 2017, its first

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents