Error corrections and adjustments

The controller for Stork Corp. is concerned about certain business transactions that the company experienced during 2020. The controller, after discussing these matters with various individuals, has come to you for advice. The transactions at issue are presented below:

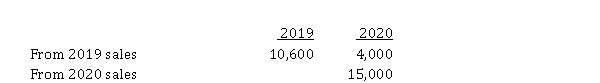

1. The company has decided to switch from the direct write-off method for accounting for bad debts to the percentage-of-sales approach. Assume that Stork has recognized bad debt expense as the receivables have actually become uncollectible in the following way:  The controller estimates that an additional $ 21,800 in bad debts will be written off in 2021: $ 3,800 applicable to 2019 sales and $ 18,000 to 2020 sales.

The controller estimates that an additional $ 21,800 in bad debts will be written off in 2021: $ 3,800 applicable to 2019 sales and $ 18,000 to 2020 sales.

2. Inventory has been shipped on consignment. These transactions have been recorded as ordinary sales and billed as such (on account). At December 31, 2020, inventory billed and in the hands of consignees amounted to $ 160,000. The percentage markup on selling price is 20%. Assume that the consigned inventory is sold the following year. The company uses the perpetual inventory system.

3. During 2020, Stork sold $ 300,000 worth of goods on the instalment basis. The cost of sales associated with these instalment sales is $ 225,000. The company inadvertently handled these sales and related costs as part of their regular sales transactions. Cash of $ 86,000, including a down payment of $ 30,000, was collected on these instalment sales during 2020. Due to questionable collectability, the instalment method was considered appropriate.

Instructions

a) Assume that Stork Corp. reported pre-tax income of $ 500,000 for 2020. Present a schedule showing the corrected pre-tax income after the above transactions are taken into account. Ignore income tax effects.

b) Prepare the correcting journal entries required at December 31, 2020, assuming that the books have been closed.

Correct Answer:

Verified

Q55: What effect do accounting changes have on

Q56: Matching disclosures to situations

In the blank to

Q57: Effects of errors on financial statements

Show how

Q58: Use the following information for questions.

Fairfax Inc.

Q59: Use the following information for questions.

Fairfax Inc.

Q60: As part of its disclosure initiative, why

Q61: Correction of errors in prior years

Goldfinch Inc.

Q62: Explain the three types of accounting changes

Q63: Explain how management should apply accounting policies

Q64: Accounting for accounting changes and error corrections

Parrot

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents