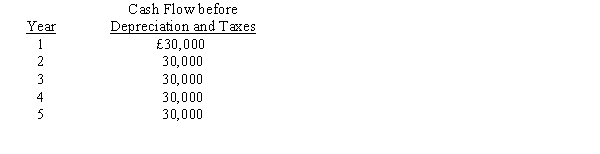

Houston Ltd.is considering an investment in equipment for £45,000. Data related to the investment are as follows:  Cost of capital is 18 per cent. Houston claims capital allowances (WDV's) using the straight-line method of depreciation. In addition, their tax rate is 40 per cent, and the life of the equipment is five years with no salvage value.

Cost of capital is 18 per cent. Houston claims capital allowances (WDV's) using the straight-line method of depreciation. In addition, their tax rate is 40 per cent, and the life of the equipment is five years with no salvage value.

What is the net present value of the investment?

A) £67,543

B) £22,543

C) £48,810

D) £11,286

Correct Answer:

Verified

Q2: Jolly Ltd.is considering an investment in equipment

Q3: A firm has £1,000,000 of long-term bonds

Q5: Which of the following is least likely

Q6: Which of the following is included in

Q7: Young Company has a tax rate of

Q8: If an asset is sold for more

Q13: A follow-up analysis of an investment decision

Q15: Which of the following is a common

Q16: If the tax rate is 40 per

Q18: If an asset is sold for less

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents