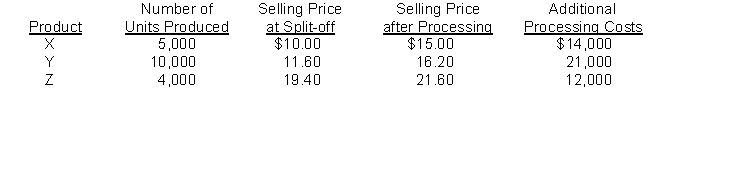

A company manufactures three products using the same production process. The costs incurred up to the split-off point are $200,000. These costs are allocated to the products on the basis of their sales value at the split-off point. The number of units produced, the selling prices per unit of the three products at the split-off point and after further processing, and the additional processing costs are as follow:

Instructions

(a) Which product(s) should be processed further and which should be sold at the split-off point?

(b) Would your decision be different if the company was using the quantity of output to allocate joint costs? Explain.

Correct Answer:

Verified

Pr...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q179: Kasten, Inc. budgeted 10,000 widgets for production

Q180: Agler Corporation currently manufactures a subassembly for

Q181: Mercer has three product lines in its

Q181: The process used to identify the financial

Q185: The potential benefit that may be obtained

Q185: Harris Timber Corporation uses a machine that

Q186: Larkin, Inc. uses 1,000 units of the

Q187: Trump Forest Corporation operates two divisions, the

Q189: Milwaukee, Inc. has three divisions: Bud, Wise,

Q194: An important purpose of management accounting is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents