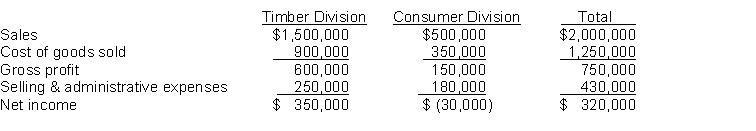

Trump Forest Corporation operates two divisions, the Timber Division and the Consumer Division. The Timber Division manufactures and sells logs to paper manufacturers. The Consumer Division operates retail lumber mills which sell a variety of products in the do-it-yourself homeowner market. The company is considering disposing of the Consumer Division since it has been consistently unprofitable for a number of years. The income statements for the two divisions for the year ended December 31, 2016 are presented below:

In the Consumer Division, 70% of the cost of goods sold are variable costs and 35% of selling and administrative expenses are variable costs. The management of the company feels it can save $45,000 of fixed cost of goods sold and $50,000 of fixed selling expenses if it discontinues operation of the Consumer Division.

Instructions

(a) Determine whether the company should discontinue operating the Consumer Division.

(b) If the company had discontinued the division for 2016, determine what net income would have been.

Correct Answer:

Verified

Q181: The process used to identify the financial

Q184: A company manufactures three products using the

Q185: Harris Timber Corporation uses a machine that

Q185: The potential benefit that may be obtained

Q186: Larkin, Inc. uses 1,000 units of the

Q189: Milwaukee, Inc. has three divisions: Bud, Wise,

Q190: Match the items below by entering the

Q191: A recent accounting graduate from Marvel State

Q194: An important purpose of management accounting is

Q214: A decision whether to sell a product

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents