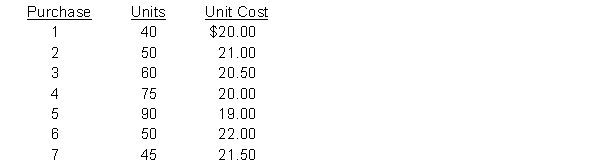

McLaughlin Inc. began business in the current month. The bookkeeper received a report from an outside firm specializing in physical inventory counts that the ending inventory was $1,426.60. However, according to the bookkeeper's records, the inventory at month end was $1,517.50. The bookkeeper has rechecked his records several times and still comes up with the same amount. He believes that the difference between the two amounts must be due to inventory shrinkage. The company had no inventory at the beginning of the month and 70 units on hand per a physical inventory count at the end of the month. The company uses the periodic method. Listed below are the company's purchases for the month:  Instructions

Instructions

Write an explanation for the bookkeeper on how the difference in amounts could occur. (Hint: use different cost formulas to calculate the ending inventory). Provide numerical support.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: Explain how the choice of inventory cost

Q87: Bertin's Boutique Inc., a furniture store, uses

Q88: A car dealership specializing in luxury vehicles

Q89: Prairie Fruit is a fruit distributor located

Q90: Jolly Gyms Inc. uses a periodic inventory

Q91: Compare and contrast a perpetual and a

Q92: Meredith Ltd. uses the periodic inventory system,

Q93: A friend of your works for a

Q94: Superior Slippers Ltd. uses the gross margin

Q95: Manchego Co. uses a periodic inventory system

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents