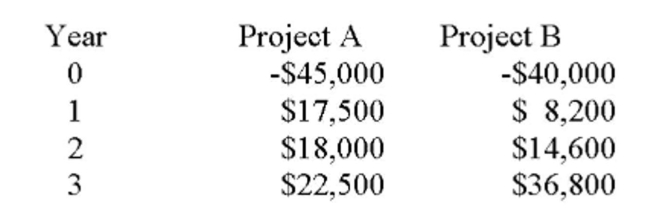

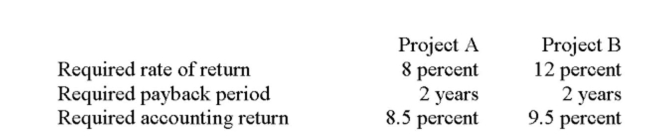

You are considering the following two mutually exclusive projects with the following cash flows. Both projects will be depreciated using straight-line depreciation to a zero book value over the life

Of the project. Neither project has any salvage value.

You should accept Project _____ because its internal rate of return (IRR) is _____ percent.

You should accept Project _____ because its internal rate of return (IRR) is _____ percent.

A) A; 13.22

B) A; 14.67

C) B; 13.92

D) B; 17.79

E) The IRR should not be used to determine which of these projects should be accepted.

Correct Answer:

Verified

Q249: Generally, the most difficult part of utilizing

Q250: You are considering two independent projects with

Q251: Which of the following is considered to

Q252: You should accept Project _ because it

Q253: If the discount rate is 14% and

Q255: You are considering two mutually exclusive projects

Q256: The purchase of new equipment is classified

Q257: The Commodore Co. is trying to decide

Q258: The essence of _ is determining whether

Q259: The internal rate of return is:

A) More

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents