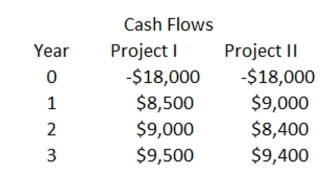

The Commodore Co. is trying to decide between the following two mutually exclusive projects:  The only requirement the company has is that any project that is accepted must produce a minimum rate of return of 11%. What should the company do and why?

The only requirement the company has is that any project that is accepted must produce a minimum rate of return of 11%. What should the company do and why?

A) Both projects should be accepted because their payback periods are only about 2 years.

B) Both projects should be accepted because they have IRRs of 22.87% and 28.45%, which exceed the 11% requirement.

C) Both projects should be accepted because they both have positive NPVs.

D) Project I should be accepted because it has an NPV of $3,908.58. Project II cannot also be accepted.

E) Project II should be accepted because it has an IRR of 28.45%, which is greater than Project I's IRR.

Correct Answer:

Verified

Q252: You should accept Project _ because it

Q253: If the discount rate is 14% and

Q254: You are considering the following two mutually

Q255: You are considering two mutually exclusive projects

Q256: The purchase of new equipment is classified

Q258: The essence of _ is determining whether

Q259: The internal rate of return is:

A) More

Q260: You are considering the following two mutually

Q261: Floyd Clymer is the CFO of Bonavista

Q262: You have a choice between two mutually

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents