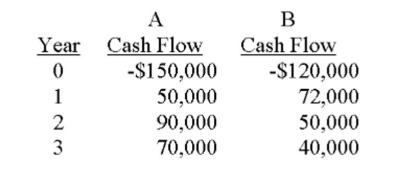

You have a choice between two mutually exclusive investments. If you require a 14% return, which investment should you choose?

A) Project B, because it has a smaller initial investment.

B) Project A, because it has a higher NPV.

C) Either one, because they have the same profitability indexes.

D) Project B, because it has the higher internal rate of return.

E) Project B, because it pays back faster.

Correct Answer:

Verified

Q257: The Commodore Co. is trying to decide

Q258: The essence of _ is determining whether

Q259: The internal rate of return is:

A) More

Q260: You are considering the following two mutually

Q261: Floyd Clymer is the CFO of Bonavista

Q261: Which of the following is a correct

Q264: Graphing the crossover point helps explain:

A) Why

Q265: A manager will prefer the IRR rule

Q266: The internal rate of return tends to

Q267: The present value created per dollar invested

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents