Julian is a part-time nonexempt employee in Nashville, Tennessee, who earns $21.50 per hour. During the last biweekly pay period he worked 45 hours, 5 of which are considered overtime. He is single with one withholding allowance (use the wage-bracket table) . What is his net pay? (Do not round intermediate

Calculations. Round your final answer to 2 decimal places.)

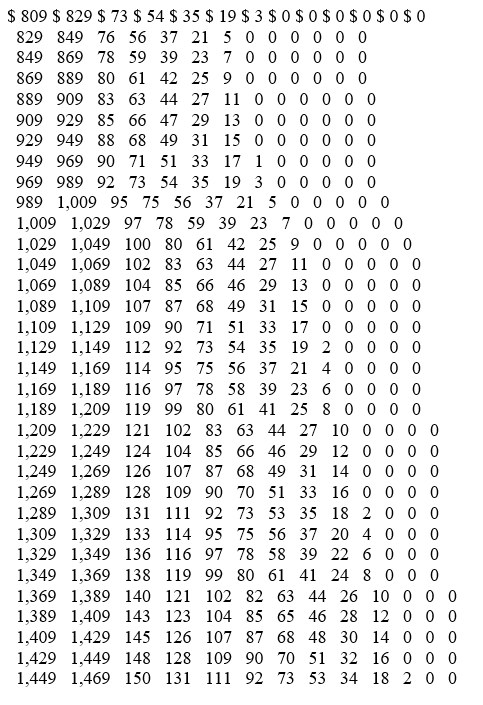

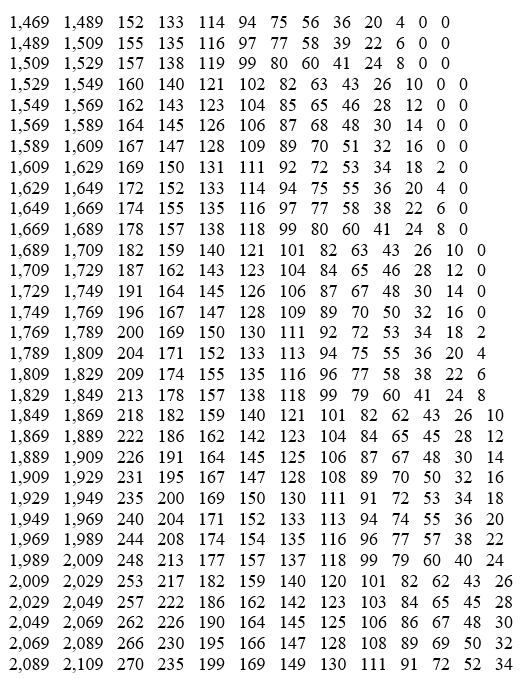

Wage Bracket Method Tables for Income Tax Withholding

SINGLE Persons-BIWEEKLY Payroll Period

(For Wages Paid through December 2019)

And the wages are And the number of withholding allowances claimed is-

At least But lessthan 0 1 2 3The amount of income tax to be withheld is-4 5 6 7 8 9 10

A) $865.11

B) $825.99

C) $797.18

Correct Answer:

Verified

Q7: Social Security tax has a wage base,

Q18: Which of the following federal withholding allowance

Q19: Which of the following states do not

Q20: The amount of federal income tax decreases

Q21: Trish earned $1,734.90 during the most recent

Q23: Caroljane earned $1,120 during the most recent

Q24: Garnishments may include deductions from employee wages

Q25: Wyatt is a full-time exempt music engineer

Q26: Sammy contributes 4% of her salary to

Q27: Disposable income is defined as:

A) An employee's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents