Caroljane earned $1,120 during the most recent pay biweekly pay period. She contributes 4% of her gross pay to her 401(k) plan. She is single and has 1 withholding allowance. Based on the following table, how much Federal income tax should be withheld from her pay?

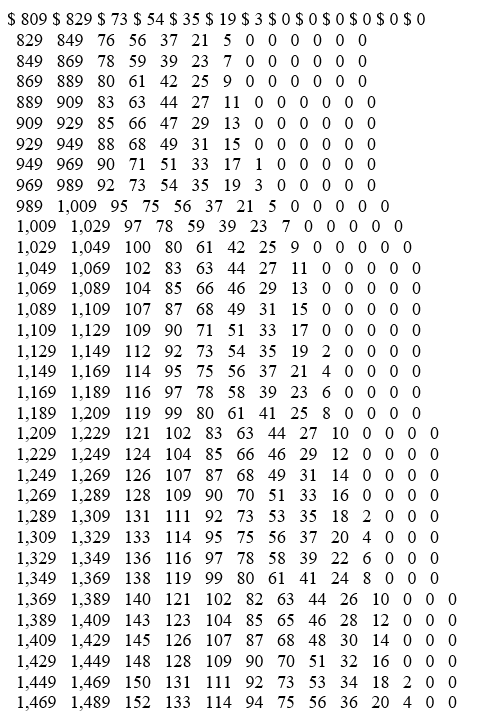

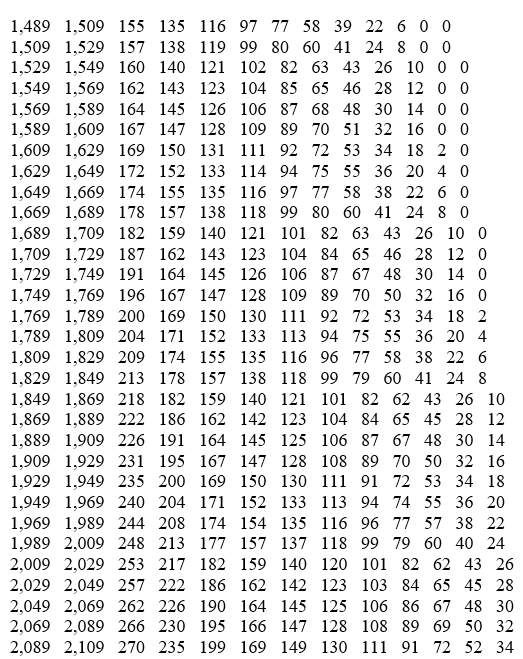

Wage Bracket Method Tables for Income Tax Withholding

SINGLE Persons-BIWEEKLY Payroll Period

(For Wages Paid through December 2019)

And the wages are And the number of withholding allowances claimed is-

At least But lessthan 0 1 2 3The amount of income tax to be withheld is-4 5 6 7 8 9 10

A) $106.00

B) $104.00

C) $87.00

D) $85.00

Correct Answer:

Verified

Q18: Which of the following federal withholding allowance

Q19: Which of the following states do not

Q20: The amount of federal income tax decreases

Q21: Trish earned $1,734.90 during the most recent

Q22: Julian is a part-time nonexempt employee in

Q24: Garnishments may include deductions from employee wages

Q25: Wyatt is a full-time exempt music engineer

Q26: Sammy contributes 4% of her salary to

Q27: Disposable income is defined as:

A) An employee's

Q28: Tierney is a full-time nonexempt salaried employee

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents