Tierney is a full-time nonexempt salaried employee who earns $990 per biweekly pay period. She is single with 1 withholding allowance and both lives and works in Bowling Green, Kentucky. Assuming that she had no overtime, what is the total of her Federal and state taxes for a pay period? (Use the wage-bracket

Tables. Kentucky state income rate is 5.00%. Round final answer to 2 decimal places.)

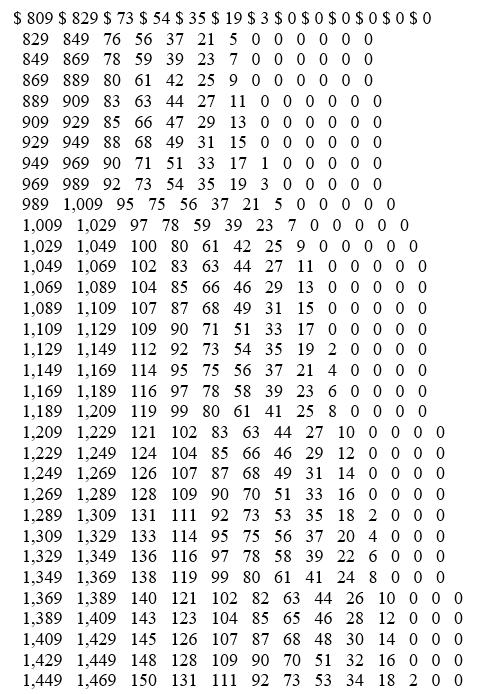

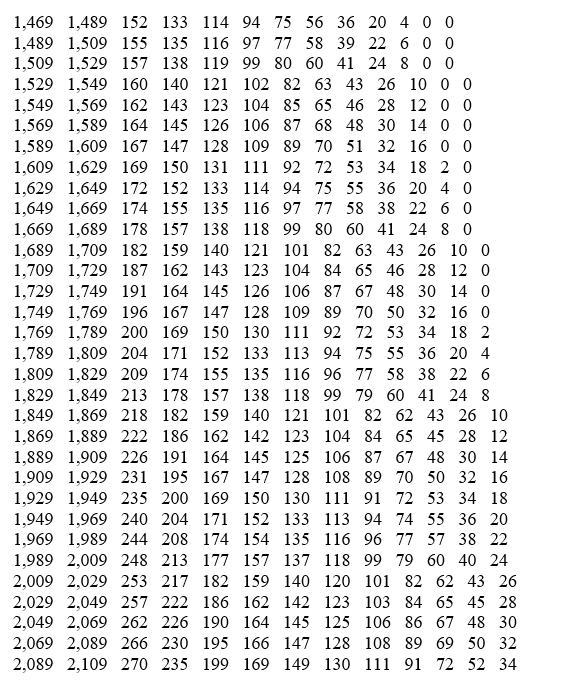

Wage Bracket Method Tables for Income Tax Withholding

SINGLE Persons-BIWEEKLY Payroll Period

(For Wages Paid through December 2019)

And the wages are And the number of withholding allowances claimed is-

At least But lessthan 0 1 2 3The amount of income tax to be withheld is-4 5 6 7 8 9 10

A) $128.25

B) $124.50

C) $120.78

Correct Answer:

Verified

Q23: Caroljane earned $1,120 during the most recent

Q24: Garnishments may include deductions from employee wages

Q25: Wyatt is a full-time exempt music engineer

Q26: Sammy contributes 4% of her salary to

Q27: Disposable income is defined as:

A) An employee's

Q29: Steve is a full-time exempt employee at

Q30: Natalia is a full-time exempt employee who

Q31: Why might an employee elect to have

Q32: Warren is a married employee with six

Q33: Paolo is a part-time security guard for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents