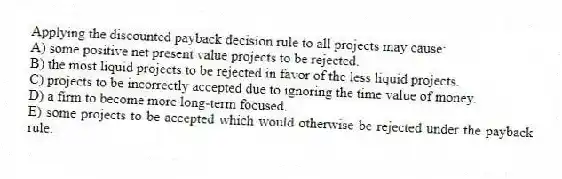

Applying the discounted payback decision rule to all projects may cause:

A) some positive net present value projects to be rejected.

B) the most liquid projects to be rejected in favor of the less liquid projects.

C) projects to be incorrectly accepted due to ignoring the time value of money.

D) a firm to become more long-term focused.

E) some projects to be accepted which would otherwise be rejected under the payback rule.

Correct Answer:

Verified

Q13: Which of the following are advantages of

Q14: A project has a required payback period

Q15: Which one of the following methods of

Q16: Which one of the following will decrease

Q17: Why is payback often used as the

Q19: If a project has a net present

Q20: The average accounting rate of return (AAR):

A)

Q21: Assume a project is independent with financing

Q22: Southern Chicken is considering two projects. Project

Q23: The internal rate of return is defined

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents