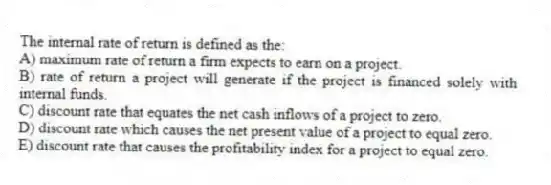

The internal rate of return is defined as the:

A) maximum rate of return a firm expects to earn on a project.

B) rate of return a project will generate if the project is financed solely with internal funds.

C) discount rate that equates the net cash inflows of a project to zero.

D) discount rate which causes the net present value of a project to equal zero.

E) discount rate that causes the profitability index for a project to equal zero.

Correct Answer:

Verified

Q18: Applying the discounted payback decision rule to

Q19: If a project has a net present

Q20: The average accounting rate of return (AAR):

A)

Q21: Assume a project is independent with financing

Q22: Southern Chicken is considering two projects. Project

Q24: If a firm accepts Project A it

Q25: A project with financing type cash flows

Q26: The internal rate of return:

A) may produce

Q27: An advantage of the average accounting return

Q28: A strength of the average accounting return

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents