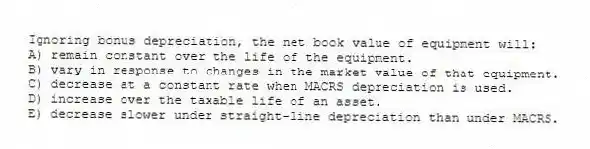

Ignoring bonus depreciation, the net book value of equipment will:

A) remain constant over the life of the equipment.

B) vary in response to changes in the market value of that equipment.

C) decrease at a constant rate when MACRS depreciation is used.

D) increase over the taxable life of an asset.

E) decrease slower under straight-line depreciation than under MACRS.

Correct Answer:

Verified

Q35: P.A. Petroleum just purchased some equipment at

Q36: The top-down approach to computing the operating

Q37: The annual annuity stream of payments that

Q38: Atlas Manufacturing purchased a new computer system

Q39: The bid price is the:

A) price you

Q41: Currently, GH Co. sells 42,600 handbags annually

Q42: High Breeze is considering expanding on some

Q43: Mason Farms purchased a building for $689,000

Q44: Winn Corp. currently sells 9,820 motor homes

Q45: Nelson Mfg. owns a manufacturing facility that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents