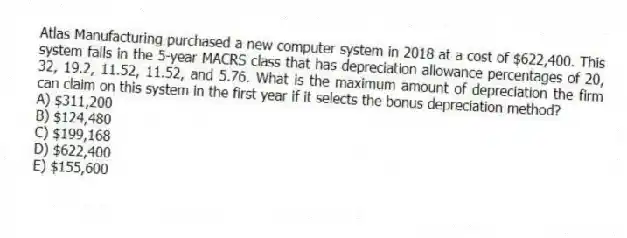

Atlas Manufacturing purchased a new computer system in 2018 at a cost of $622,400. This system falls in the 5-year MACRS class that has depreciation allowance percentages of 20, 32, 19.2, 11.52, 11.52, and 5.76. What is the maximum amount of depreciation the firm can claim on this system in the first year if it selects the bonus depreciation method?

A) $311,200

B) $124,480

C) $199,168

D) $622,400

E) $155,600

Correct Answer:

Verified

Q33: A company that utilizes the MACRS system

Q34: Which one of the following statements is

Q35: P.A. Petroleum just purchased some equipment at

Q36: The top-down approach to computing the operating

Q37: The annual annuity stream of payments that

Q39: The bid price is the:

A) price you

Q40: Ignoring bonus depreciation, the net book value

Q41: Currently, GH Co. sells 42,600 handbags annually

Q42: High Breeze is considering expanding on some

Q43: Mason Farms purchased a building for $689,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents