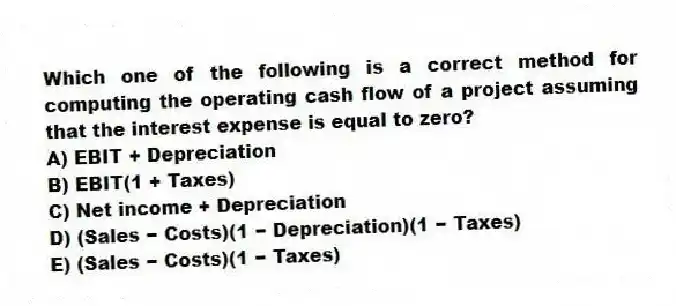

Which one of the following is a correct method for computing the operating cash flow of a project assuming that the interest expense is equal to zero?

A) EBIT + Depreciation

B) EBIT(1 + Taxes)

C) Net income + Depreciation

D) (Sales − Costs) (1 − Depreciation) (1 − Taxes)

E) (Sales − Costs) (1 − Taxes)

Correct Answer:

Verified

Q17: The difference between a company's future cash

Q18: Which one of the following should not

Q19: Changes in the net working capital requirements:

A)

Q20: GL Plastics spent $1,200 last week repairing

Q21: Which one of the following will increase

Q23: Dexter Smith & Co. is replacing a

Q24: The depreciation tax shield is best defined

Q25: Three years ago, Knox Glass purchased a

Q26: The bottom-up approach to computing the operating

Q27: Increasing which one of the following will

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents