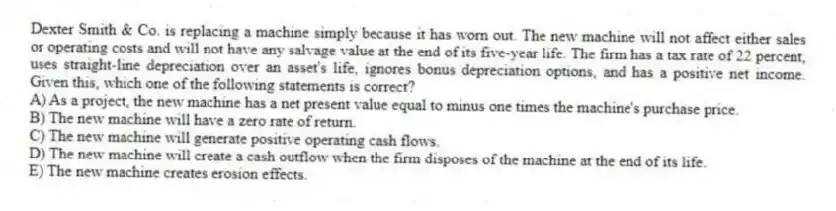

Dexter Smith & Co. is replacing a machine simply because it has worn out. The new machine will not affect either sales or operating costs and will not have any salvage value at the end of its five-year life. The firm has a tax rate of 22 percent, uses straight-line depreciation over an asset's life, ignores bonus depreciation options, and has a positive net income. Given this, which one of the following statements is correct?

A) As a project, the new machine has a net present value equal to minus one times the machine's purchase price.

B) The new machine will have a zero rate of return.

C) The new machine will generate positive operating cash flows.

D) The new machine will create a cash outflow when the firm disposes of the machine at the end of its life.

E) The new machine creates erosion effects.

Correct Answer:

Verified

Q18: Which one of the following should not

Q19: Changes in the net working capital requirements:

A)

Q20: GL Plastics spent $1,200 last week repairing

Q21: Which one of the following will increase

Q22: Which one of the following is a

Q24: The depreciation tax shield is best defined

Q25: Three years ago, Knox Glass purchased a

Q26: The bottom-up approach to computing the operating

Q27: Increasing which one of the following will

Q28: The operating cash flow of a cost-cutting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents