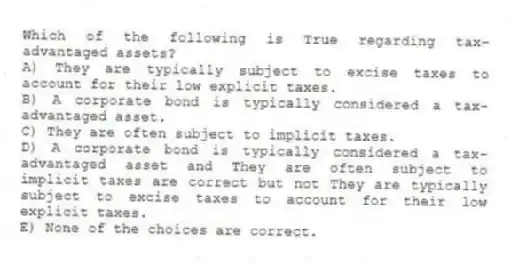

Which of the following is True regarding tax-advantaged assets?

A) They are typically subject to excise taxes to account for their low explicit taxes.

B) A corporate bond is typically considered a tax-advantaged asset.

C) They are often subject to implicit taxes.

D) A corporate bond is typically considered a tax-advantaged asset and They are often subject to implicit taxes are correct but not They are typically subject to excise taxes to account for their low explicit taxes.

E) None of the choices are correct.

Correct Answer:

Verified

Q73: Leonardo, who is married but files separately,

Q74: Which of the following is True regarding

Q75: Manny, a single taxpayer, earns $65,000 per

Q76: Congress recently approved a new, smaller budget

Q77: Leonardo, who is married but files separately,

Q79: Geronimo files his tax return as a

Q80: Leonardo, who is married but files separately,

Q81: Jackson has the choice to invest in

Q82: Jonah, a single taxpayer, earns $150,000 in

Q83: Evaluate the U.S. federal tax system on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents